Analysis of Listings on AeRo in 2021

16 May 2022

Year 2021 has brought a lot of enthusiasm for BVB, higher yields, new issuers and investors. BET Index registered a 33.2% increase, one of the highest in the history of the stock exchange, namely 40% after the inclusion of dividends. Amid the economic recovery and investor’s interest, brokers have very well identified the need of a substantial representation of certain economic sectors on the local stock market, such as IT and agriculture. At the same time, entrepreneurs sensed the potential for business development and visibility offered by the listing of their companies on the stock exchange. The wave of 2021 listings included businesses in the field of IT, agriculture, services, retail, real-estate and manufacture and was optimistically supported by investors through a high degree of offering over-subscription.

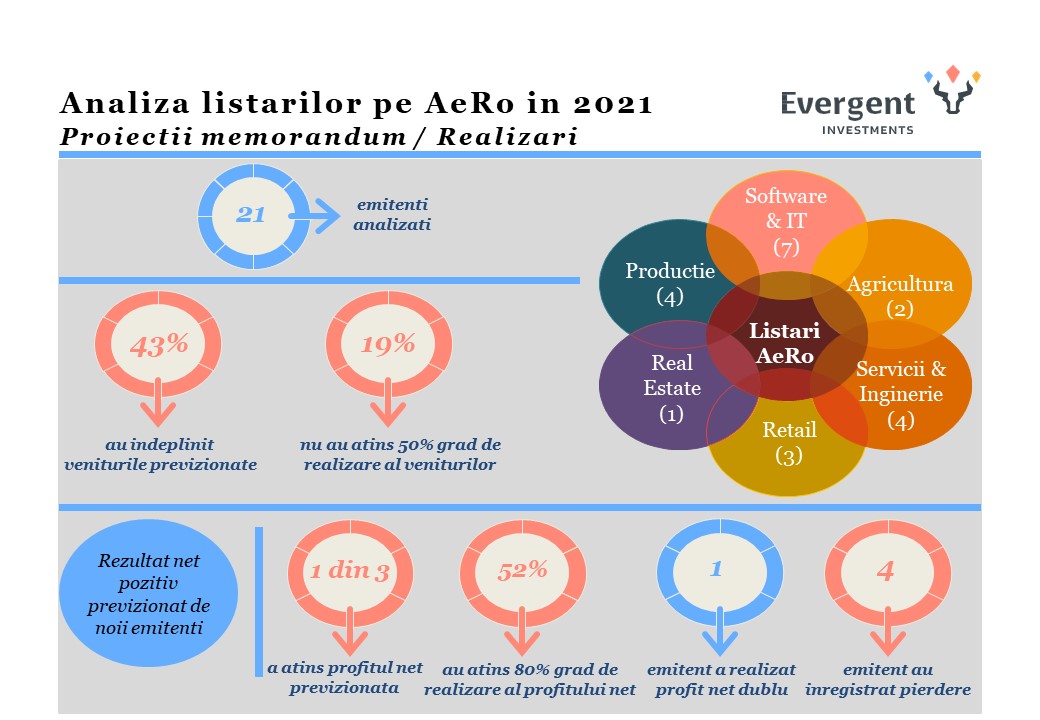

The publication of financial results and annual reports allowed us to evaluate the performances of the 21 companies listed on AeRo and the extent to which investors’ expectations generated by the promises in the listing memoranda were met.

One third of the companies reached their expected profitability and 52% of them reached a degree of net profit achievement of over 80%. I have also noticed that in 2021 one company achieved a net profit double than the forecast, while 4 other companies (19%) registered a loss, although all predicted net positive results for 2021 in the documents presented for listing.

43% of the companies met the expected revenues, while one in five did not reach 50% revenue achievement degree.

The analysis indicates a discrepancy between investors’ expectations and annual financial results, much below the promises in the offer documents. In fact, the downward trend for most new issuers on the local stock market manifested itself before the start of the conflict in Ukraine, as new information about them appeared. Their evolution also highlights the aspects that need to be improved: transparency, corporate governance, the preparation of realistic budgets and the creation of solid financial departments.

At the same time, I notice the need for a rigorous selection and a thorough diligence on the part of brokers in choosing the future issuers, preparing the offer documents and setting the prices.

The shareholders’ trust in the partners they collaborate with is an essential element for the success of the company that is to be listed, brokerage company and for the development of the capital market as a whole. As we all know, trust is hard to earn and can be lost very easily.

Romanian capital market continues to develop and the entrepreneurs who decide to bring their business on the stock market should be guided for the assimilation of capital market rigors which involve partnership with shareholders, clear strategies, realistic forecasts and corporate governance.

Bogdan Vasile, investment analyst of EVERGENT Investments, covers private investments, listings on Aero and main market. With a master’s degree in Finance & Investments from Rotterdam School of Management, Holland, Bogdan has over 10 years’ experience in investment analysis.